community-based, non-corporate, participatory media

community-based, non-corporate, participatory media

Penn State attempts no-bid sale of Circleville Farm to S&A Homes

by Justin Leto

Thursday, Jan. 23, 2003 at 5:54 AM

jleto@psu.edu (814) 861-2445

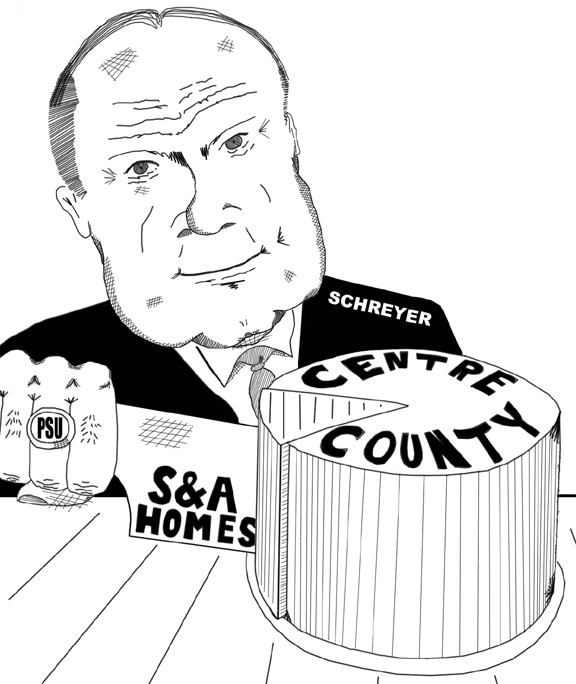

A no-bid $2.6 million sale of prime university land would have benefited local developer Robert Poole, CEO of S&A Homes, and former Penn State Trustee William Schreyer, who holds more than a 10% interest in the company.

Penn State University officials suddenly abandoned a no-bid sale of the 155-acre Circleville Farm to S&A Homes after news of the plan sparked a firestorm of criticism from students, faculty, and residents.

At issue is whether a tax-payer supported university planned a no-bid $2.6 million sale of prime university land to benefit local developer Robert Poole, CEO of S&A Homes, and former Penn State Trustee William Schreyer, who holds more than a 10% interest in the company. A competitive bidding process would have increased the revenue from the sale for Penn State by raising the price paid by the winning bidder.

The handling of this most recent land deal was in stark contrast to how the university handled bidding for The Village at Penn State. While the village project is no model for transparency, it was opened up for competitive bidding in April 1997. The university sent requests for information to 62 firms across the country.

No requests for information were sent this time around.

Also embedded in the deal was a feature that would allow only developers with previous local experience to opt out of the contract if the necessary rezoning could not be obtained from Ferguson Township. Currently, Circleville Farm is zoned as Rural Agricultural (RA).

Interestingly, Poole appeared before Ferguson Township supervisors July 2, 2002 to submit a request to amend a building height restriction for Rural Agricultural (RA) zones that would raise the limit on any side of a house from 40 feet to 47 feet. For RA zones, land can be subdivided down to 25-acre tracts for each house built for farming use.

Appraisal of the 155-acre farm put the value at $2.6 million, contingent on a rezoning of the land to allow low and medium density residential development. Penn State hired two appraisal firms, Philip E. Gingerich Appraisal and Consulting Services of Lewistown and the Rutherford Appraisal and Consulting group of State College. Philip Gingerich has since retired from the firm, leaving Chris Aumiller to run the business. Aumiller’s wife currently works in the office of the vice-provost for undergraduate education at Penn State.

In mid-September, a week after the proposed sale to S&A Homes was made public, plans were mysteriously nixed.

Legitimacy, ex-post-facto

Officials maintain that another developer came forward shortly after the proposed sale appeared on the Board’s agenda to offer Penn State more money for the land, prompting the university to establish a 27-day period for new bids. By the end of the bidding period, only five bids were submitted.

Critics complained that such a short bidding period favored S&A Homes, who had inside knowledge of the university’s intentions months before other bidders. In response, the university decided to reject all bids and announce that a new opportunity for bidding would occur "in a few months."

The actual vote of the sale may be delayed until summer, a time when the most controversial business of the university is conducted. Officials have also said that the winning bid will not be known until the day of the vote adding that neither the process of selecting the best bid nor the details of each proposal will made public.

Stephen MacCarthy, vice president for university relations, said that the public might only see the top three proposals when the matter is presented to the board.

Controversy, however, is still brewing over what almost transpired and the clumsy efforts made ex-post-facto to establish the deal’s legitimacy.

Plan? What plan?

At a November 22nd Board of Trustees meeting, a number of Penn State Trustees and a top university official bristled at the suggestion that a secretive Circleville Farm sale to S&A Homes ever existed -- even going on record to deny them outright.

The exchange was reported by The Daily Collegian.

Trustee William Weiss defended fellow industrial trustee emeritus William Schreyer against insinuations of a conflict of interest. An edgy piece on the story ran in the Pittsburgh Post-Gazette November 17th.

"There have been many, many writings that have impugned the integrity of this Board of Trustees, and in particular impugns the integrity of Bill Schreyer," Weiss said.

"I'd like the record to stand that the board rejects that [sale] absolutely," he added.

Undergraduate Student Government President Rubina Javeri appeared before the Board to question the proposed sale referring to the university’s commitment to protect green space.

Gary Schultz, senior vice president for finance and business, rebuked Javeri.

"First off, I don't know where you heard that, but it is absolutely false," Schultz said to Javeri. "We'll be moving forward in a very open and fair process, as we always do. I can assure you it will be fair."

Javeri might have first heard about it months ago in the September 7th edition of The Centre Daily Times. In the article, Stephen MacCarthy announced that university officials would make a presentation on the proposed sale of Circleville Farm at the September 13th board meeting. The sale appeared on the Board’s agenda.

MacCarthy again confirmed that the university had originally intended to sell the land to S&A Homes because S&A agreed to pay the price set by the appraisers. The university stopped short only after another developer approached the university with a higher bid.

The Triumvirate

The informal syndicate of Robert Poole, William Schreyer and Philip Sieg has arranged every major sale of university land in recent years.

Born in Philadelphia, Robert Poole graduated from Penn State in 1972 with a degree in accounting. He has been the president of S&A Homes since 1982.

In 1999, he gave half a million dollars to endow a faculty fellowship in real estate studies under The Smeal College of Business Administration. He provided a graduate assistantship in the University Libraries and a number of undergraduate scholarships for Penn State athletes and students enrolled in the Schreyer Honors College. His role in fundraising has been similarly conspicuous. He is Vice Chairman of the Centre Region Component of the Penn State Grand Design, which claims to have raised close to one billion dollars by June.

Mr. Poole’s altruism tends to contain its own reward. Although his affection towards his alma mater is undoubted, university authorities tend to favor S&A Homes in any ambitious development project on university land.

Conveniently enough for an aggressive real estate developer, Poole currently sits on the Centre County Agricultural Land Preservation Board. This post has obvious benefits at a time when he was simultaneously negotiating with Penn State to purchase the 155-acre Circleville farm, currently zoned agricultural, but coveted by developers as a lucrative site for a housing development. Poole is also a member of the Centre County Farmland Trust.

William A. Schreyer was born in 1928 and graduated from Penn State in 1948.

He was former chief executive officer of Merrill Lynch & Co., Inc., one of the largest investment and banking companies in the world. Schreyer also served as the vice-chairman of the board for The New York Stock Exchange between 1987 and 1990.

Schreyer’s contributions to the university exceed $33 million.

The university’s adherence to an expansionist policy to achieve an international status is embodied in a speech Schreyer delivered to the board in 1993.

"Our best days are ahead of us. I believe that if the university community rises to the challenge, Penn State can quickly advance its reputation as one of the very finest institutions of higher education and research -- not just on the East Coast or in North America, but in the entire world."

His influence guided the largest expansion in the university’s history, marked by building projects totaling $700 million in 5 years.

Philip Sieg, who manages Sieg Financial Group, maintains a lower profile than Poole or Schreyer. A Bellefonte native and Penn State alumnus (1957), he is an important donor to the university and is an honorary member of the Smeal College of Business fundraising committee.

The Village at Penn State

Poole has been notably mum on his plans for Circleville Farm, in contrast to his eloquent and very public defense of The Village at Penn State.

Back when the Village was being debated several trustees raised questions of a conflict of interest.

Former Trustee Ben Novak opposed a deal with Pinnacle Development, saying there was an appearance of a conflict of interest because of the involvement of Schreyer and Paterno.

The involvement of university bigwigs such as Paterno and Schreyer led many bidders to pull out before the process had concluded. The word on the street was that with so much university involvement, and a late merge between Pinnacle and the Cooperative Retirement Services of America (CRSA), the deal seemed to already be inked.

Despite the submission of 69 proposals from around the country, the project was awarded to Pinnacle and CRSA as expected.

Even today, there continues to be a revolving door connecting the higher reaches of the Penn State administration with Pinnacle Development. Upon retirement from her post as senior vice president for administration, one intimately connected with the Village project, Carol Hermann became the formal director of Pinnacle. Her replacement, Jan Jacobs now sits on the board of the Village at Penn State.

No cover for S&A

One thing Poole would like to have is Penn State head football coach, Joe Paterno, as a partner. Paterno provided the necessary cover to Pinnacle Development and CRSA, insulating the project from wider criticism.

Also missing from the Circleville Farm deal is the ability to use Penn State’s name and prestige to market the final product, as had been done with the retirement village.

Bob Poole involvement, stripped of any supporting cast of celebrities, suggests that a sale of Circleville Farm to S&A would benefit a very specific member of the Penn State community.

| TITLE | AUTHOR | DATE |

|---|---|---|

| maybe it's boring . . . | andy | Monday, Jan. 27, 2003 at 3:07 PM |

| please remove CURRENT post too | Ish-Kabibble | Monday, Jan. 27, 2003 at 3:01 PM |

| please remove previous post | justin | Thursday, Jan. 23, 2003 at 5:57 AM |